Marble Falls sales tax receipts show big gains for two industry segments

STAFF WRITER JARED FIELDS

Marble Falls’s November state sales tax allocation increased 3.88 percent from the prior year’s amount, according to the state comptroller’s office.

The growth in November’s allocation — which is based on September receipts — is the ninth month in 2018 the city has received more than the comparable month in 2017.

This month’s allocation, while positive, was the fourth consecutive month for growth under 4 percent.

“I expect our growth to remain at the current level until new construction projects get kicked off early in 2019,” said Marble Falls Economic Development Corp. Executive Director Christian Fletcher.

The November net payment was $789,232.29, up from $759,701.74 in November 2017.

For the 11 months so far in 2018, the city’s allocation has been $8,084,339.89, a 1.93 percent increase from the first 11 months of 2017.

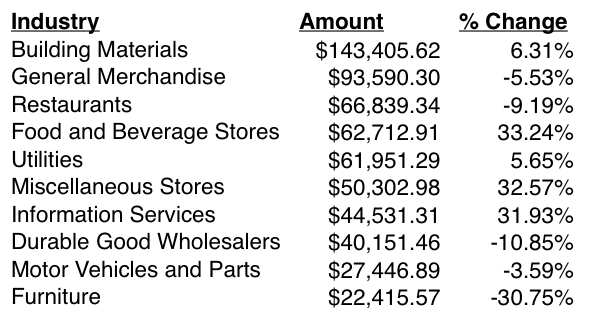

A breakdown of the city’s mid-level report again shows the building materials industry leading all other industries in Marble Falls. The building materials industry had a 6.31 percent increase over the previous year.

Two industries — miscellaneous stores and information services — saw increases of more than 30 percent from the previous year.

“In Miscellaneous Stores, there were a couple of outlets that posted very big months,” Fletcher wrote in an email response. “[I]n the Information Services sector, 10 out of the top 11 taxpayers saw growth — including 4 out of the top 5 with double-digit growth.”

The next sales tax report will be distributed in December from October receipts.

jared@thepicayune.com

This article was orginally found here: